Germany enters 2026 confronting profound geopolitical turbulence, as Chancellor Friedrich Merz’s government grapples with strained transatlantic ties, unwavering commitments to Ukraine, economic recalibrations with China, and delicate balancing acts in the Middle East. Rapid shifts, including U.S. protectionism under President Trump and evolving global alliances, challenge Germany’s traditional foreign policy framework.

US relations under Trump-Merz pragmatism

Germany’s relationship with the United States has shifted toward realistic cooperation since Friedrich Merz assumed the chancellorship, differing with Donald Trump’s before particular jaundice toward Angela Merkel. Unlike the first Trump term marked by pressures over defense spending and energy policy, the current dynamic emphasizes concessions on trade to save transatlantic bonds, including Germany’s support for a U.S.- EU frame trade agreement amid 15 tariffs on EU goods like buses and wood products. near collaboration in energy with nearly 80 of Germany’s 2023 LNG significances from the U.S. and defense, bolstered by plans to land 15 F- 35 spurts, four P- 8A Poseidon aircraft, three Typhon launchers, and 400 Tomahawk dumdums, positions Germany as the top U.S. mate in Europe, hosting 39,000 of 85,000 American colors there.

Merz’s government has increased military spending to align with NATO’s 5 GDP target demanded at the 2025 Hague peak, signaling readiness to assume lesser European security liabilities amid implicit U.S. pivots to the Indo- Pacific. This includes nuclear consultations with France and the UK to round U.S. deterrence, while navigating MAGA exams and AfD sympathies from Trump’s circle. Trade conflicts persist, with U.S. tariffs at 25 for exchanges and 50 for sword straining Germany’s import frugality, yet Merz pursues diversification via EU- Mercosur and India deals to alleviate pitfalls. Overall, Berlin’s political yielding on economics aims to forestall escalation, though divergences over China could test this equilibrium, as Germany resists full alignment with Washington’s hawkish station.

Profitable interdependence remains robust in 2024, U.S.- German trade hit€ 253 billion, comprising 15 of U.S.- EU summations, with the U.S. catching China as Germany’s top mate. Merz’s June and August 2025 White House visits, including alongside Zelenskyy, emphasize this fellowship, alongside securing immunity from U.S. warrants on Rosneft Deutschland. Yet, structural challenges like German military bureaucracy and public disinclination, only 16 explosively willing to defend in parts, complicate Berlin’s intentions to make Europe’s largest conventional army. As Trump prioritizes America First, Germany’s strategy hinges on gradational burden- sharing to maintain U.S. engagement without rupture.

Ukraine support amid prolonged conflict

Germany remains Ukraine’s largest European patron and alternate encyclopedically, committing €36 billion in mercenary aid and €40 billion in military backing by September 2025, including air defense, downtime relief, and mine concurrence. Finance Minister Klingbeil pledged €9 billion($10.5 billion) further through 2026 during an August 2025 Zelenskyy meeting, reaffirming Berlin’s station” As long as this war continues, we will stand by Ukraine’s side.” Total aid since 2022 nears €44 billion($51 billion), encompassing energy support and stabilization for displaced persons.

Merz’s leadership has sustained this “Zeitenwende” pivot, integrating Ukraine aid into a broader NATO reinforcement strategy responsive to U.S. demands. Challenges include domestic fatigue and economic pressures from the war, yet Germany’s role in Zelenskyy’s Alaska summit coalition with Trump highlights its diplomatic bridging. Air defense systems like Patriots and IRIS-T, plus humanitarian packages, underscore commitments, though delivery delays and U.S. policy unpredictability strain pacing.

As 2026 looms, Berlin faces balancing acts: sustaining aid without overextending amid U.S. potential drawdowns, while pushing European unity. Analyst Herfried Münkler notes the illusion of rules-based order crumbling, urging realism in support. Germany’s strategy involves multilateral partners like Brazil and Vietnam for diversified networks, ensuring Ukraine’s resilience against Russian advances.

China ties and de-risking efforts

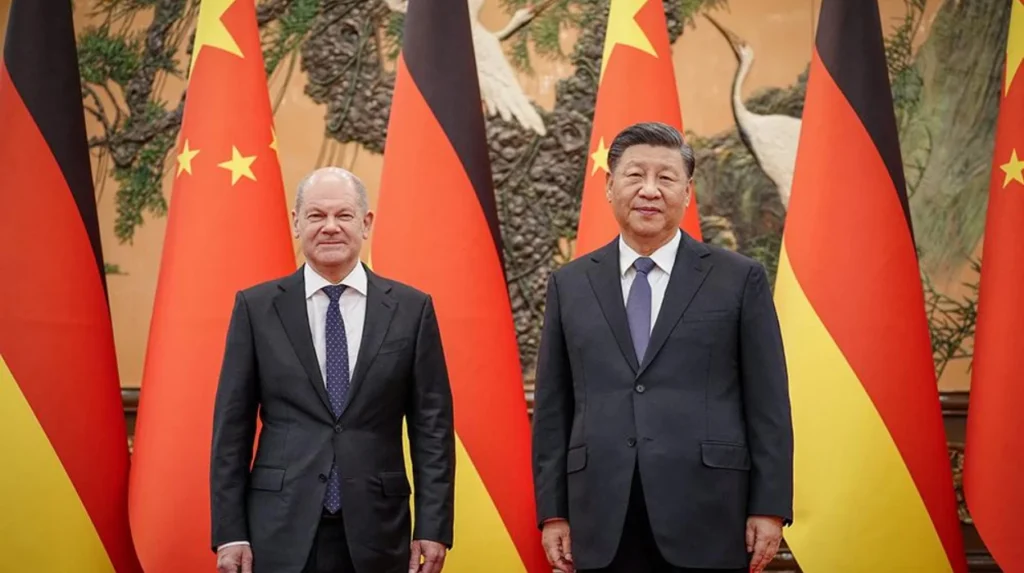

Under Merz, Germany pursues “de-risking without decoupling” from China, its former top trade partner now eclipsed by the U.S., amid €246 billion bilateral trade in 2024. Coalition agreements label China a “systemic rival,” targeting reduced dependencies in electronics and rare earths, with €14.6 billion German investments there from 2022-2024. Exports to China dipped 0.9% to €6.7 billion in January 2025, imports 2.8% to €2.9 billion, reflecting weaker demand and competition.

Merz urges firms to pivot to “stable” markets like the U.S. and Latin America, refusing bailouts for “risky” China betters a shift from Scholz-era protectionism. Foreign Minister Wadephul highlights South China Sea threats to European interests, aligning with EU pushes for reciprocity and subsidy curbs. Industry lobbies like BDI back protections if conditions met, while Greens keep tariffs viable.

Tensions with Washington arise here: U.S. views China as existential foe, Germany as multifaceted partner. Slow de-risking persists due to 5,000+ German firms in China planning expansions, complicating neutrality in U.S.-China rivalry. SPD lawmakers call for strategy rethink post-Wadephul’s Beijing trip postponement. Into 2026, expect EU-coordinated responses to subsidies, preserving ties cautiously.

Middle East policy shifts

Germany’s steadfast Israel alliance faced 2025 strains over Gaza, with Merz suspending arms exports usable there “until further notice” in August after Netanyahu’s Gaza City takeover plan. This marked a “huge deal” policy pivot, admitting discomfort with Israeli actions, though restrictions were lifted by November amid criticisms. Merz rejected Palestinian Gaza refugees in August, visited Israel in December meeting Netanyahu and Herzog on support, peace, and arms deals.

Historical ties drive solidarity, but the Gaza war tests it amid humanitarian concerns. Balancing acts extend to the broader Middle East: Iran’s proxies, Houthis disrupting shipping vital to German trade. Merz’s moves signal pragmatic limits to unconditional backing, navigating domestic protests and EU dynamics.

Professor Johannes Varwick advises multilateralism with middle powers like Mexico for leverage. As shifts accelerate, Germany eyes regional de-escalation to secure energy and trade routes.

Economic impacts of geopolitical stress

Geopolitical upheaval exacerbates Germany’s stagnation: 2025 GDP growth at 0.1%, 2026 projected 1.3%, hit by U.S. tariffs, China competition, skilled labor shortages, bureaucracy. Protectionism and uncertainty weigh short-term; debt expansion aids long-term but crowds out private investment. Export reliance amplifies vulnerabilities: U.S. tariffs on autos (15%), steel (50%); China slowdowns.

Merz’s diversification, Mercosur, India counters this, alongside LNG from the U.S. Defense hikes boost U.S. procurement, stabilizing ties economically. Yet, RWI’s Torsten Schmidt warns intensified tensions demand structural reforms urgently.

Navigating 2026’s multipolar world

Germany seeks multilateral anchors amid “idealism’s illusion,” per Münkler, partnering middle powers like Brazil, Vietnam. Merz’s two-track approach: short-term U.S. concessions, long-term European pillar via Bundeswehr expansion. Risks include MAGA meddling, China frictions, aid fatigue.

Berlin consolidates EU unity on China, Ukraine; hedges U.S. withdrawal. Success hinges on gradual adaptation, avoiding over-reliance.